Instant Personal Loan in Minutes, Not Days

Unlock Your Financial Freedom!

Receive a magic link on your mobile and apply for a instant personal loan in just a few simple steps—no app install required!

Quick Apply

Get instant loan approval in minutes

Our Digital Lending Partners

We collaborate with leading NBFC partners to offer you the best digital financial solutions.

Our Trusted Loan Distributor Partners

We collaborate with leading Private Banks and premium loan distribution partners to offer you the best financial solutions

Loan Processing In 4 Simple Steps

Register Phone Number

Start with just your mobile number - no app installation needed

Receive a magic link on your phone to begin the digital application process immediately.

Select Loan Product

Choose from personal, car, home, business, or education loans

Browse our competitive rates and select the loan that best fits your needs and eligibility.

KYC & Credit Verification

Complete secure digital verification with AI-powered assessment

Our soft credit check doesn't affect your score. Instant AI assessment provides quick approval.

Instant Disbursement

Get funds transferred directly to your bank account

Digital loans: 30 seconds disbursal. Other loans: within 24 hours. Real-time tracking available.

Frequently Asked Questions

-

What is EASYCRED and what is its purpose?

EASYCRED is a revolutionary AI-powered loan aggregation platform that connects borrowers with lenders through a seamless digital process. Our purpose is to democratize access to credit and make financial solutions accessible to every Indian, whether you're an individual seeking personal finance or a business needing capital.

For Individuals

Personal, Car, Home, and Education Loans with competitive rates

For Business

Business Loans, Working Capital, and Mortgage solutions

Fast Processing

Digital loan approval and disbursement in 30 seconds

-

What loan products does EASYCRED offer?

We offer a comprehensive range of financial products tailored to different needs:

Instant Personal Loan

₹50,000 to ₹5 Lakhs | Minimal documentation | Instant approval

Car Loan

Up to 90% financing | Flexible tenure | Competitive rates

Home Loan

Up to ₹5 Crores | Long tenure options | Quick approvals

Education Loan

For India & abroad studies | ROI starts from 7.0% | Moratorium period

Business Loan

Customized solutions | Collateral options available | Growth financing

Working Capital

Manage operations | Flexible repayment | Quick disbursal

-

How does EASYCRED work?

Our 4-step process makes getting a loan simpler than ever:

1Register Phone Number

Enter your mobile number to begin. No app installation required.

2Select Loan Product

Choose from our range of loan products based on your needs.

3KYC/Credit Verification

Complete quick verification with our secure, AI-powered process.

4Disbursed In 24 Hrs

Get funds transferred to your account. For digital loans: 30 seconds!

-

What makes EASYCRED different from traditional lenders?

Our Unique Selling Proposition (USP) combines speed, technology, and customer-centric design:

- Lightning-Fast Processing: 30-second disbursal vs industry average of 24-48 hours

- No Impact on Credit Score: Soft credit check during application

- Minimal Documentation: Digital process with no physical paperwork

- AI-Powered Platform: Instant credit evaluation using advanced algorithms

- Single Access to Multiple Lenders: We aggregate offers from leading NBFCs and banks

- Complete Transparency: No hidden charges, clear terms upfront

- Bank-Grade Security: Enterprise-level protection for your data

Time Savings

No branch visits, 100% online

Cost Efficiency

Competitive rates through our partner network

Security & Trust

RBI-approved lending partners

-

How fast is the loan approval and disbursement process?

Speed is at the core of our service. Here's what you can expect:

Digital Personal Loans

30 Seconds for approval & disbursement

Standard Processing

24-72 Hours for most loan products

Document Verification

Instant AI-powered KYC verification

Note: Processing times may vary based on the loan product, amount, and completeness of documentation provided. Digital loans have the fastest processing as they use our AI assessment system.

-

Who are EASYCRED's lending partners?

We partner with RBI-approved financial institutions to ensure regulatory compliance and offer you the best rates:

Our Digital Lending Partners:

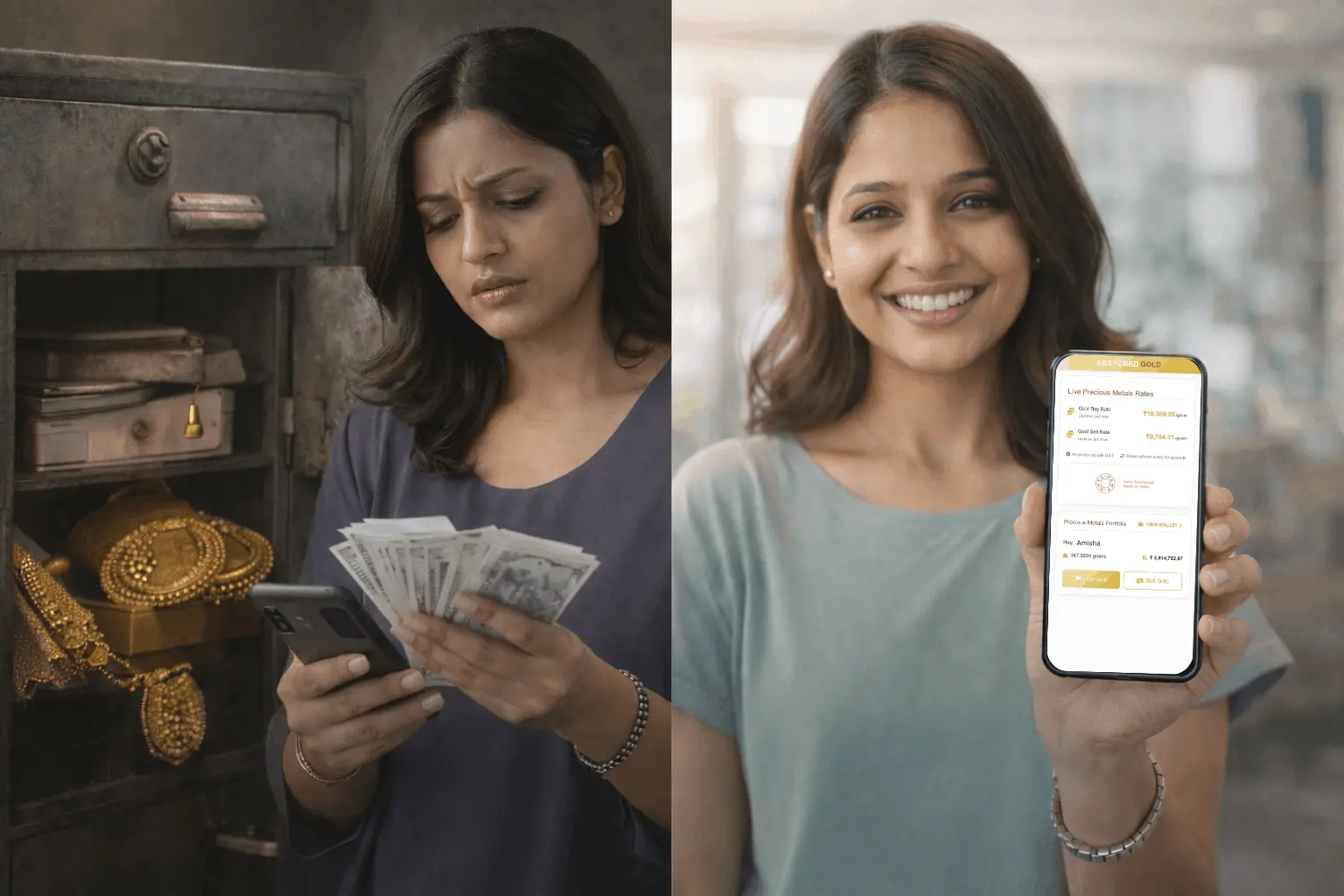

FIBEOLYVZYPEINCRED FinanceOur Loan Distributor Partners:

ANDROMEDA LOANSMyMudraRuloansTechnology Partners:

JUSPAYMMTC PAMPThese partnerships allow us to offer a wide range of financial products while ensuring you get competitive rates through our aggregation model. We act as your single point of access to multiple lenders.